Ordinals, Inscriptions, and Rare Sats - Oh my!

zk X NULLISH x Tony Tafuro - Scroll all the way down to skip to the alpha

At a very strange time in my life, during the first week of February, I stumbled upon the enigmatic concept of "Ordinal Theory". From that moment on, my life took a surreal turn. I fried not one but two high-end Alienware CPUs, slept no more than a couple of hours per night, and resigned from my finance day job to start a collection on Ordinals - Ordinal Maxi Biz (OMB)

If you're not yet privy to the intricacies of Ordinals, allow me to provide a quick overview of what sets them apart from traditional NFTs. As a true believer in their potential to serve as on-chain stores of value for collectors, I am excited to share my insights with you and explain why Ordinals are set up to flip the market cap of ETH and SOL NFTs combined before the years out.

As if that wasn't enough, I am joined by Nullish, a co-author who I consider to be the foremost expert in rare satoshi hunting. Together, we'll share some valuable context on the work we did together and at the end we drop some alpha about our collections.

So buckle the fuck up, as we take you on a thrilling journey into the world of Ordinals and rare satoshi hunting.

ORDINALS TLDR:

The inherent qualities of Ordinals are a product of both ordinal theory and the the way Bitcoin works. The differences are not merely confined to the individual NFT level, but extend to the infrastructure layer. While these nuances may seem insignificant to many at present, they will undoubtedly define an ecosystem that surpasses alt chain NFTs in meeting the needs of true store of value collectors as the NFT/digital artifact market matures.

Allow me to present some of the unique attributes that are integral to the Ordinal ecosystem, along with brief explanations that will further illustrate their superiority.

DIRECTLY ON CHAIN

Inscriptions live directly on-chain. No side chain, no tokens, no bullshit. (It's first for a reason). For blockchain enthusiast, the Ordinal ecosystem represents a quantum leap forward in the world of NFTs, thanks to the fact that all data from inscriptions is stored ON-CHAIN. Unlike other NFTs on Ethereum or Solana, which rely on metadata stored off-chain and introduces a layer of uncertainty and trust issues, Ordinals exist purely on the blockchain with no extraneous tokens or side chains (you could use a pointer but we are keeping it simple). This provides a level of security and integrity that is simply unmatched compared to any other chain or server.

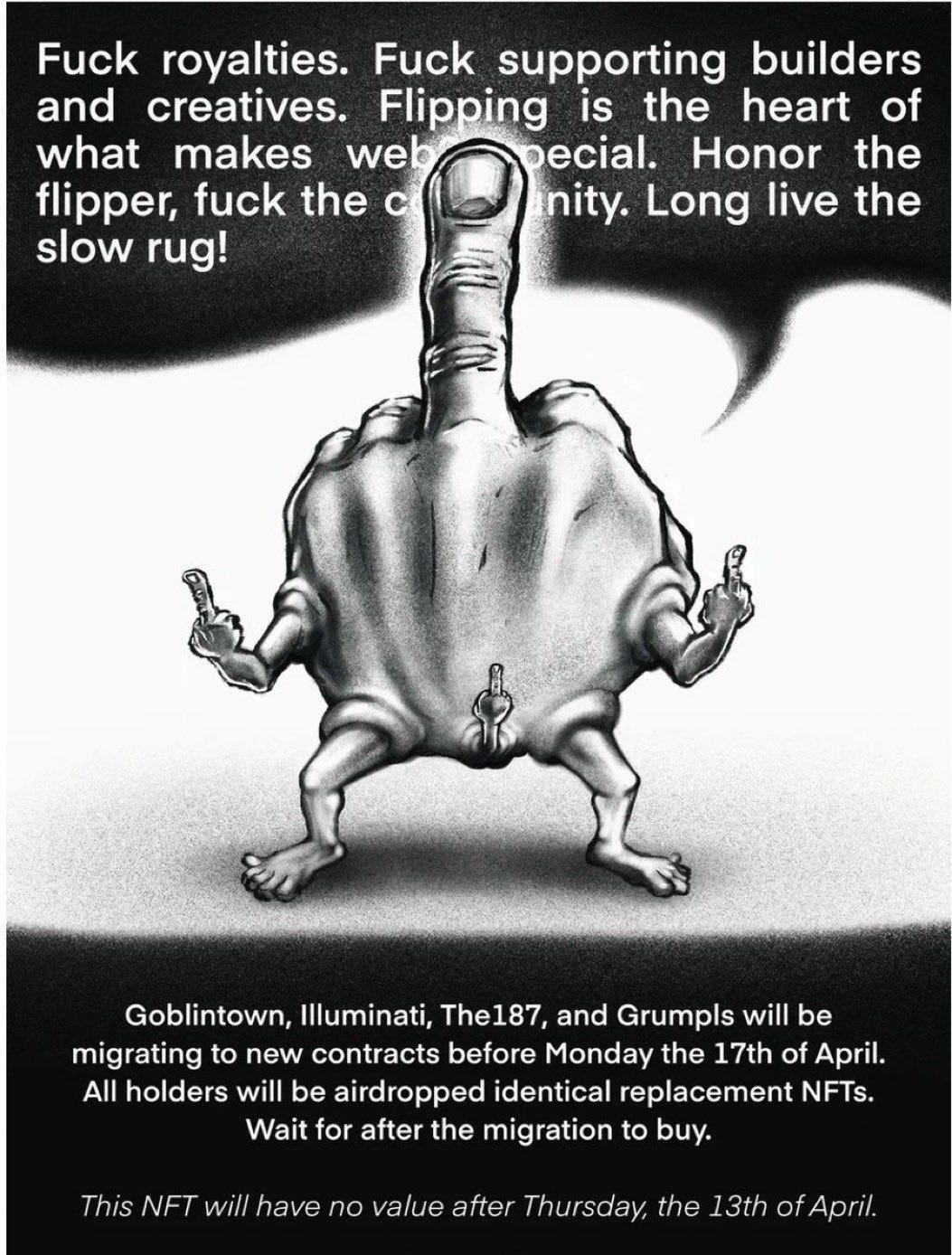

Moreover, the potential vulnerabilities of off-chain storage are becoming increasingly apparent, as illustrated by the Goblintown tweet below. Ordinals are immune to such vulnerabilities, as they are self-contained and fully secured by the bitcoin network. In contrast, other NFTs represent mere ownership of a pointer image file to off-chain data controlled by a centralized update authority. If you had to burn the Monalisa to a chain to live forever as a NFT – what chain would you choose ? The correct answer is Bitcoin...

Goblintown updated all of the NFT metadata to show the below image. Imagine if you paid 10 ETH for a Goblin (bozo), you had it displayed at your house, then during a dinner party its updated to the below image…. A maneuver like this would be impossible on Ordinals - thus more likely as a chain to attract serious collectors.

Inscriptions are numbered (dilution counter)

How many NFTs exist on Ethereum and Solana? It can be calculated on chain but the total amount of NFTs on ETH/SOL is pretty much unknown (hint: a fuckload) . However, unlike other chains, every inscription is numbered chronologically (recently passed the 2 million mark - shout out Domo). This unique feature presents interesting new dynamics. As the barrier to entry for inscribing drops, and the rate of inscribing increases, early numbers will become more desirable naturally. However, over time, as the market gets priced out of early inscriptions, and inscription numbers become less significant (low % of total inscriptions are low numbers) – the underlying Satoshi will become more and more important.

Inscription numbers provide an additional level of collectability in several ways. Lower numbers are generally more desired, unique numbers such as 69,420 and round number bias feeders like 100,000, collection-specific numbers like 420,000, and personal subjective preferences (birthdays?) all contribute to value. Because metadata for inscriptions does not exist directly, marketplaces will sort by inscription numbers (ascending, descending, sub 10k, 1m, etc.) and eventually by the underlying Satoshis. As the marketplaces begin to sort by metrics related to the underlying sat, and when the market participants start understanding this dynamic – inscriptions on old/rare sats will quickly become the new meta. The other key takeaway is that all of the value related to the inscription numbers is not correlated with the underlying art or collection. Thus, inscription numbers or other attributes related to the ordering of inscription hold some type of value not related to the underlying art… This is a new dynamic in the world of internet jpegs.

Intrinsic Value

On Ethereum, you simply create a smart contract, pay some gas, and mint a significant number of NFTs. The marginal cost for increasing the NFT supply on ETH is mostly fixed and varies inconsequentially considering that the metadata is off chain. No direct causal relationship exist between the actual image/file size you see and the fees paid on chain when referencing ETH or SOL. This mainly encourages supply increases and new collections... While Ethereum is deflationary and sharding should improve gas costs significantly, the intrinsic value (or cost to mint the NFTs) is not directly correlated with a scarce resource (on-chain storage).

Furthermore, every inscription is competing for Bitcoin block space, or in other words, the fee paid must out compete every other transaction floating around in the mempool in order to get inscribed. If you're long-term bullish on Bitcoin and digital scarcity, Bitcoin block space will be one of the scarcest commodities. Fees have already increased significantly, resulting in the increasing cost of inscribing, which leads to a higher fee, and ultimately, a higher price for the seller to break even. Therefore, if you're an economic-minded individual, you'll realize that the scarcity of Bitcoin block space will have a significant impact on the future intrinsic value of inscriptions. The right inscriptions (in terms of collectability) are essentially a call option on future bitcoin blockspace in my head.

Royalties

Royalties are a contentious issue in the world of NFTs. While chains like ETH and SOL now enforce or incentivize them with shitcoins/prizes at the marketplace level, native Ordinal marketplaces merely have fees of around 2%. Additionally, most creators on Bitcoin do not expect royalties which, in my opinion, is a good thing. After all, most traders have PTSD from the royalty battles that have plagued ETH and SOL.

This issue will become even more important in the near future for three main reasons. Firstly, having no royalties provides a cleaner regulatory landscape, which is critical given the increased scrutiny of the NFT space by regulators. Second, it removes the incentive for announcements about announcements, which are often used to artificially inflate prices. Finally, it stops a lot of the Ponzi-nomics/ Revenue distribution bull shit associated with NFTs on other chains, which is essential for the long-term sustainability of the market.

Moreover, the absence of royalties encourages a more thoughtful/creative approach to collection size and removes the incentive for malicious royalty farming. This not only benefits creators but also helps prevents marketplace wars (or marketplace partnerships with collections) that can harm the entire ecosystem via artificial liquidity. By embracing this approach, Bitcoin will likely attract high-value, low-frequency artists who can command the highest mint price compared to any other chain. Overall, while painful for artist accustomed to ETH or SOL royalties - it's clear to me that the lack of royalties are a positive in terms of long term ecosystem sustainability. The market will adjust naturally as royalties are doomed by design (check out my previous newsletters).

Immutability

Immutability is a defining characteristic of inscriptions. While this may seem self-evident, it's important to note that most NFTs on other chains are not truly immutable. While this can provide some interesting features, such as when degods upgraded their art to deadgods, in the long run, any “feature” of an NFT contract that can change the image is a liability. This is reflected in the price, whether one realizes it or not. If an art collector had to choose between on-chain immutable storage and a mutable option, what do you think they would prefer? As the choice becomes more apparent, it's clear that Bitcoin is the superior option for storing high-value, low-frequency art as a store of value due to its TRUE immutability.

Uncensorable

What price would you pay for storing a file on the most decentralized and secure file server available to humans? With Inscriptions, you have just that. Imagine being able to expose publish publicly without fear of censorship, shadow bans, and the crowd fav de-platforming. The potential for Inscriptions to play a crucial role in the fight against censorship is powerful, especially in nation state vs decentralized state cold war . Inscriptions can't be taken down and open source block explorers can be easily reproduced without permission – truly immutable and uncensorable.

https://twitter.com/LeonidasNFT/status/1651653545249177600?s=20

https://twitter.com/ZK_shark/status/1650689125580668931?s=20

Dumb Smart Contracts

In terms of the "smart contract" experience, Bitcoin is often underestimated. While some may argue that Ethereum or other blockchain platforms have more advanced smart contract capabilities, the user experience for on-boarding is significantly better on Bitcoin. This is largely due to the absence of complex smart contracts and exchange-based protocols that require multiple forms of stagnant trust and standing permissions. As a result, fake mint links and other security vulnerabilities like the drainer exploits are far less frequent on Bitcoin due to its smart contract limitations, cost, frequency, and speed of minting. Overall, while Bitcoin may have limited smart contract functionality compared to other platforms, it offers a more streamlined and secure experience for users.

Bitcoin Market cap

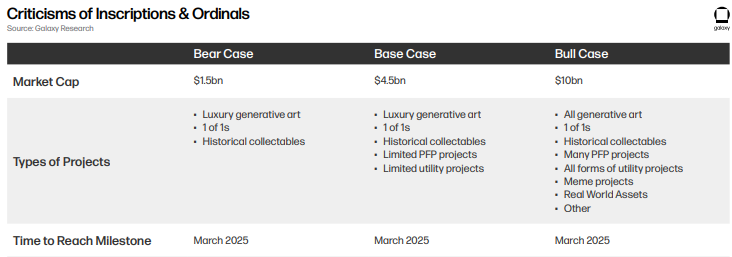

”A New $5bn Market” - Galaxy Research (26 pg research report)… Pic speaks for itself.

I literally have a list of 8 more bullet points that I can go on about but you guys get the point… Along with some massive ecosystem co-signs from Yuga, Degods, Bugatti, Magic Eden, and Binance (?) - Ordinals can’t be stopped. Lets chat on sats…

OLD vs RARE

From my experience as a poker player, trader on wall st, art collector and NFT enthusiast etc, I've always obsessed over the true value versus market value of various assets and derivatives. On the crypto side, I've spent countless hours contemplating what is genuinely collectible, desirable, and what will age well as the crypto ecosystem matures, and most importantly, what the market undervalues.

Let's start with rare sats. While they may be alluring, owning them is akin to buying into a theory - a theory that some guy made up (Love you Casey). I think Rare sats will be tremendously collectible when you consider the insane number of sats in existence and market participants needed for validation, however, I think true Bitcoiners and collectors will allign more with the emotional side and narrative of single/double digit blocks.

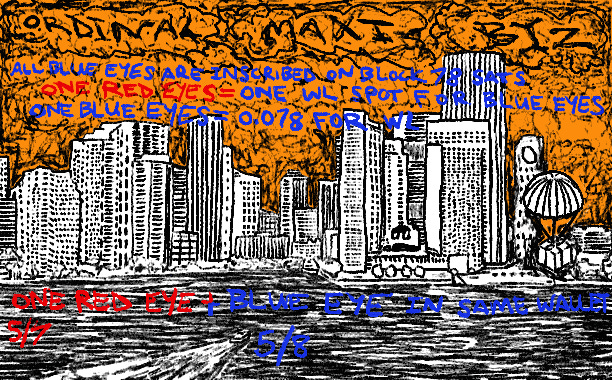

Now, why did I opt to inscribe OMB Blue Eyes on Block 78 and not Uncommon sats? There are three main points to consider. Firstly, the on-chain providence of old sats being associated with a newer transaction on a blockchain is a new dynamic thanks to Ordinal Theory. Very few blockchains – (if any ?) allow you to "attach" an older timestamp or associate it with a fresh transaction. In fact, most blockchains are designed to do the opposite. This creates a “on-chain paradox” that is just simply cool - OMBs that Tony drew in 2023 are now inscribed on bitcoin from 2009 (block 78 mfer!) and the relationship is all documented on chain.

Secondly, let's take a look at Nullish's recent sale of uncommon sats. It was a nice display of market appreciation for sats. However, what caught my attention was that the earliest uncommon sats sold first. This trend suggests that early market participants are already aligned with my way of thinking and are likely to value the earliest uncommon sats the highest, which naturally associates earlier sats with higher values.

Lastly, there's the question of theory versus on-chain proof. Casey's rare sat documentation is off-chain, while early sats are on-chain in my opinion. A mere glance at the bitcoin network would reveal the value of a January 2009 sat or a double, triple block number, evoking emotions related to the early days of bitcoin for those in the know. In comparison, the first sat of block 834,534 lacks such sentimental value and is also not as prominently displayed on block explorers. It's clear which one will age better over time - what provokes more emotion ? **Block 78 is stupid fucking ealry and the extreme part of the example and that’s the same reason I chose to inscribe on it ;). “Early” is a very relative term…

In Conclusion, the dynamic interplay between old and rare sats is nothing short of awe-inspiring. With Ordinal theory's introduction of the fungible and non-fungible relationships to Bitcoin, we are poised to witness a plethora of unexpected yet incredible new digital artifacts inscribed on top of bitcoin specific artifacts (sats), which will undoubtedly captivate both blockchain enthusiasts like myself, as well as the general art collectors.

Before I pass the torch to Nullish to delve into the details of block 78, sat hunting, and sequential inscribing, there's one more thing I want to say - I've been completely captivated by Hal throughout this entire process and caught some feelings ngl. I've poured over every single one of his Bitcointalk posts and any other content I could find about him online. While Nullish does an incredible job below, I think Hal's “final post” on Bitcointalk speaks volumes. RIP HAL

https://bitcointalk.org/index.php?topic=155054.0

”When Satoshi announced the first release of the software, I grabbed it right away. I think I was the first person besides Satoshi to run bitcoin. I mined block 70-something…”

Nullish on Ordinals:

Uncommon, Historic and Exotic Satoshis

In the ever-expanding world of crypto, the Ordinal standard has emerged as a classification system that allows users to rank satoshis (sats) based on their unique attributes, creating a new layer of rarity within the Bitcoin ecosystem. Casey Rodarmor first thought of Ordinal Theory as a numbering scheme that relies on FIFO methodology to track the location of sats since their creation (in a block where they are mined). Solely with this numbering scheme, you can find exotic sats mined on a certain date that means a lot to you, you can find the first sats mined in a block, and much more. It is quite literally coin collecting, on-chain.

On the other hand, inscriptions are simply the data that is appended to a specific sat via witness data, and displayed by an indexer or marketplace. The aspect of inscribing data on specific sats is what brought the popularity of Ordinals to sky-rocket over the past three months. However, only a select few individuals and collections have given due consideration to the sats they choose for inscriptions.

Hal Finney’s Block 78

As a crypto artist and developer, I decided to venture beyond inscriptions in February, after reading about Ordinal theory, embarking on an ambitious mission to unearth elusive digital gems—old and exotic sats—hidden within wallets and exchanges. This journey led me to the discovery of the Hal Sats from Block 78, which I named as such in honor of the late Hal Finney, a Bitcoin pioneer and cypherpunk. Holding historical significance as part of the first Bitcoin block mined by someone other than Satoshi Nakamoto, these sats represent an impressive historical milestone for collectors like me to inscribe upon in the future.

Discussions surrounding Block 9 sats date back to 2017, long before the inception of Ordinal theory, underscoring the enduring consensus around the FIFO methodology employed by Ordinals. As the demand for digital collectibles on Bitcoin continues to surge, so does the interest in exotic and historic sats. I am happy that my discoveries have ignited a renewed curiosity in Bitcoin's hidden treasures, inspiring others to embark on their own journeys of exploration and creativity.

While searching for rare sats, I also began exploring my wallet for older sats. At the time, the oldest sats anyone had discovered were from around block 800. I had sats from block 786, and in the following days, I found more from around blocks 200, 300, and 400. Then came the astonishing moment when I discovered sats from block 78 in my wallet, freshly withdrawn from the exchange. Initially, I thought it was an error. Two-digit blocks? Could it be possible that I had sats from such an early stage in Bitcoin's history?

Intrigued, I searched for information on block 78 and quickly realized these were sats mined by Hal Finney. Memories of everything I knew about Hal flooded back. As someone who started using Bitcoin in 2013, I was familiar with Hal as Satoshi's trusted collaborator. In the following days, I immersed myself in a deep dive into Hal and Satoshi's 2009 internet archive, revisiting fixes, emails, and patches on Bitcoin's early forum.

It took me a few days to collect myself and my thoughts and I put out this medium article via a tweet.

https://twitter.com/null_ish/status/1633943381507293186

It's truly meaningful to me that projects and artists are eager to inscribe on exotic and significant sats. As someone who consistently imbues my work with deep meaning, I appreciate seeing that same dedication and passion reflected in the efforts of others as well. Indeed, inscribing a collection is one thing, but it becomes significantly more meaningful when the sats hold personal value. The legacy of Hal Finney and the cypherpunk movement he left behind carries great significance for the crypto community, zkShark, and myself. That's precisely why we chose to inscribe the Ordinal Maxi Biz Blue Eyes on sequential Hal sats, as a way to honor and celebrate this remarkable history. Each inscription was planned out manually in order to extract the (block 78) sat we are inscribing on, and to make sure we are able to inscribe the next one. It’s definitely not as easy as inscribing on random sats. If you have random sats, you don’t care which sat is inscribed on and which sats are used as padding for the inscription (inscriptions usually travel with 9,999 sats after the inscribed sat to let it be sent around). If you use the default inscription mechanism, you’d probably use up all your block 78 sats for a few inscriptions.

Next for me is the pursuit of sats from block 9, which, as per Ordinal theory (FIFO), were received by Hal Finney directly from the enigmatic Satoshi Nakamoto. My ongoing quest to locate and acquire Nakamoto's sats involves diving deep into the hot wallets of Bitcoin exchanges and wallets, analyzing transaction records, UTXOs, and identifying patterns that hint at the current whereabouts of these important sats.

Uncommon Sats:

Uncommon sats, often referred to as the "genesis sats" of each block reward, possess a unique charm in the world of Ordinals. As the very first sats in their respective block rewards, they symbolize a pivotal moment in the Bitcoin mining process when new coins emerge. Consequently, collectors and enthusiasts treasure these uncommon sats for their historical significance and the stories they represent.

Their rarity, combined with the growing demand for tokens with historical value, has elevated the worth of these first sats, transforming them into highly coveted assets. An uncommon satoshi is generated approximately every time a Bitcoin block is mined, barring the existence of rare, epic, legendary, and mythic sats. As of April 11th, 2023, the total number of uncommon sats is approximately 784,000.

Considering that there are about 1,900,000,000,000 satoshis in circulation, an uncommon sat is indeed an exceptionally rare asset.

While inscribing my Ordinal trilogy, Antimatter, On the Edge of Oblivion, and Distortion, I was already multi-tasking and hunting sats on the low, without making much noise about it. A doer such as myself has no time to talk about what he’s working on, because he is working. A few bounties were set on Ordinals.com but I was looking into my own bounty: I was looking for 50 uncommon sats on which to inscribe a meaningful collection of on-chain art I had been working on for a while.

Sat hunting is no small task. Imagine going to the bank and requesting $250,000 in pennies just so you can sort through each one trying to find the rare ones. Now remove the physical aspect, and you can suddenly use the tools you’ve programmed at your disposal to help you sift through these digital coins.

Let’s say you have a Bitcoin ($30,000 USD worth) in your wallet. This Bitcoin sits in a specific UTXO (or output). You can use an explorer such as Ordinals.com to view what sats sit in this UTXO. Simple. A range will appear as green if it contains an uncommon.

Now after scanning that, there’s no green ranges, no older sats, so you send it back to an exchange. After 3 confirmations, the exchange lets you withdraw again. Since they will sweep your deposit address later, they send you different sats. Repeat. No uncommons, no old sats.

You’re now about to try your 4th withdrawal… but now you’ve reached your $100,000 USD daily withdrawal limit. Oh. No problem, you’ll just do $100,000 USD of withdrawals daily and try to find some uncommons. Now on day 6, the exchange halts your account asking what you’re doing transferring so much money in and out. It seems you’re sending money to different wallets each time. Oh. You forgot Bitcoin is privacy-first. Each time your wallet gets some funds, it generates a new receive address. You forgot to disable it. To the exchange it seems you’re sending money to different people each time. It’ll seem like that to the IRS as well, so get ready to have to attempt to explain Ordinal theory to them.

As you might have noticed, there’s a lot of layers to sat hunting. It can be worth it for some, and not worth it for others. Personally, I’ve moved around over $163M USD between my wallet and exchanges. I have an accountant, I have a tax lawyer. All my transfers are documented. It’s a fair game I’m playing, but making Uncle Sam understand it, maybe not so fair.

So exotic and rare sats that get found and isolated to be inscribed by sat hunters do hold sweat equity, in a sense:

KYC and real-life tax implications for the sat hunters

Fees for sending, splitting and withdrawing from exchanges

Time spent sat hunting and filtering the exotics

Safety implications for hacks and drains

Sending to an exchange is never risk-free

Sending funds from a non-hardware wallet is dangerous (Ledger is always recommended)

Uncommon Patterns

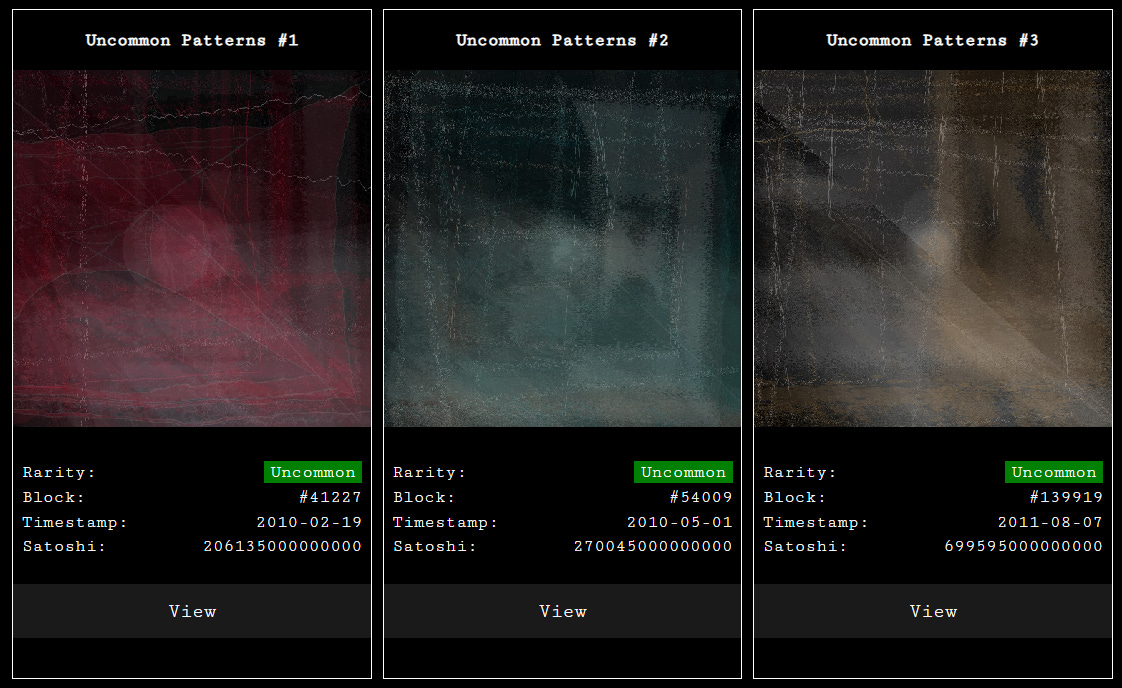

After finding all 50 uncommon sats, I inscribed Uncommon Patterns - a project I had been working on for a while.

Uncommon Patterns is the first full-feature cohesive generative Ordinal project that delves into Ordinal theory rarity. Through scalable vector graphics' turbulence filters, this simple yet output-diverse collection displays a chaotic approach to generative art. The project consists of 50 pieces, each ranked by sat age, all inscribed on uncommon sats.

A handwritten algorithm generates breathtaking pieces of art through the magic of turbulence filters, shapes and strokes. Each piece takes as input the hash of the block of the uncommon sat and uses it to generate the piece.

The first piece inscribed on the oldest uncommon sat in the collection (2010) will be auctioned at Bitcoin Miami 2023 and be displayed in the Ordinal Alley in person from May 18-20th.

The rest of the collection, pieces #2 to #49 will be auctioned off separately. Piece #50 will be fractionalized on 2,025 sequential Hal sats and be airdropped to holders of Nullish work on Bitcoin (Oblivion, Distortion).

NULLISH:

OMB: https://twitter.com/OrdinalMaxiBiz/status/1634649903556075523?s=20

COLLECTION: https://magiceden.io/ordinals/marketplace/omb

TONY TAFURO: https://twitter.com/ohareyoufat

Thanks for reading, hope you liked it - zk shark