The Alpha On On-Chain Alpha

Exploring how traders can use on-chain data to gain an unfair advantage

Mfers really don’t understand how much actionable data is available “publicly” on the blockchain. If you’re a serious crypto/nft trader just using technical and fundamental analysis - you’re only working with a TINY fraction of the information available to you. I put “public” in quotes because the information I’m describing is technically all in the public domain, however, you must know where to look, how to look, and what to look for.

The on-chain information that could potentially provide an unfair advantage over the market is a function of blockchain technology. Because of this, this type of alpha does NOT exist in any other type of trading market that I know of. In fact, traditional markets actively destroyed any edge retail traders could potentially have as they simply can’t compete with the HFT trading firms, trading algos, pricey trading infrastructure, proprietary research, market makers, and a ton of other sophisticated shit Wall Street institutions use to separate you from your cash.

To put in perspective the above point- let’s first consider the information available to the average Joe when buying a stock.

Joe is checking out Wall Street Bets and sees the next 100x (so he thinks), what actual information can he see to make a decision off of ?

retail commentary on WSB and other forums

fluff commentary from CNBC and Jim Cramer…

price of the stock, options, and other derivatives

historical pricing activity (charts)

technical indicators

company information, website, presentations (investor relations tab on the company site of any public company)

social media activity

macro research…

most retail traders hopelessly make decisions off of the above intel, most don’t bother or have the expertise to do the level of due diligence below

SEC filings

10-K, 10-Q, 8-Ks, 13Fs, S-1/3s… all provide CRITCAL information when considering investing, however, as someone who has read thousands of these reports, 10% is actual useful information and 90% of the report is legal jargon, required disclosures, and a bunch of other shit the SEC makes companies pay expensive auditors and lawyers for.

These filings definitely contain relevant and market moving info, HOWEVER, you have absolutely no edge in regards to using this information for trading . Before you even can click on the email alert (if you even have alerts setup) for a new 8-k, a fancy trading firm already used an algo to interpret the text/headlines/volume to determine if the filing is net bullish/bearish and put on a position in milliseconds after the filing drops. You have no chance…

above all, most of these reports are not publicly disclosed in a timely fashion. For example, when an activist, hedge fund, whale, or whoever (some exceptions) owns more than 4.99% of shares outstanding they are required to publicly disclose this ownership via a 13F filing, however, this could be published weeks/months after the position was put on - meaning you missed the buy pressure….

if the average Joe pays up, he can see a level 2 order book

showing the best bids and best offers with some market depth and spoofed broker codes. That information isn’t really necessary unless your a hardcore day trader using an automated strategy. Additionally, most of these order books are filled with artificial lot sizes that change quickly to front run retail traders….

With all of the above considered:

what edge does the retail trader have in tradfi markets ? ~0

BLOCKCHAIN ENTERS THE CHAT

Before we dive into the good part, I would caution that similar to TA no one tool or indicator should be relied upon independently. As with TA, on-chain information should be used as a complement to fundamental research and whatever other BS indicators you use to confirm your underlying bias.

I also want to caution my audience that deriving information from the blockchain is a technical skill and an art, that takes a lot of practice. Having a thorough understanding of how whatever blockchain you’re trading on functions and being able to read public block explorers comfortably (like etherscan or solscan) are prerequisite skills.

To demonstrate the type of alpha I’m talking about we are going to explore some real examples of how on-chain data can provide an advantage in trading shitcoins, larger cap coins, and NFTs.

The way I think about on-chain data is that my goal is to create a profile of a wallet to identify certain types of actors that move the market or know information that the market doesn’t know. Once you create/find those profiles you have to track them in real time. What kind of a profile are you looking for ? The hard part is that they come in all shapes and sizes but I go through some hypotheticals below. For example, one of the easiest on chain metrics to check is tracking the wallets of the founders, core team, whale holders, influencers, institutional players etc.

For example, imagine if you were tracking Vitaliks or the Ethereum foundations wallet address and then all of sudden they started dumping massive amounts of ETH - obviously if they ever did that it would be an extremely bearish event. The reasoning is that most likely no one understands the future of Ethereum and near/long term catalyst better than Vitalik and the foundation so if they’re selling significant amounts of ETH, why wouldn’t you start selling also?

The example was hypothetical in nature but this actually fucking happened in real time (Eth foundation dumped on you). The Etherscan transaction below is the Ethereum Foundation selling 20K of ETH worth around $100m. Big surprise, they sold the ETH at an average price of $4,722.68 on November 11 2021, suspiciously close to the ETH ATH of $4,815 on November 9th 2021. If you consider the total number of days ETH traded above $4,000 in it’s life, selling above 4k, let alone within a tiny % of the ATH it is an extremely unlikely event… Did the ETH foundation get lucky ? Did they know something the market didn’t ? Did the selling spook the market ?

https://etherscan.io/tx/0xf22e8254c32866d28f5b69f009d59ca2b45891f05e2a073b94679bd107c828a1

Hopefully that example opened your eyes to how powerful on-chain information can potentially be. There are SO many different ways on-chain info can be leveraged and unfortunately I can only fit a certain amount of text in your email inbox so I’m just going to throw some rapid fire examples at you below to hopefully open your mind up a tad.

Historical P&L

There are tons of resources that allow you to copy and paste wallet addresses to see the historical profit and loss of the wallets entire transaction history. You can also use virtually any crypto tax software to see a wallets trading record and profit.

Imagine if you come across a wallet that has made over $50m trading crypto by only making 25 trades without having any losers - and now you can set up alerts/monitor that activity ? Do you understand how valuable that information could be?

I would caution that most serious traders use multiple wallets and constantly move assets around, it’s definitely NOT easy to come across a wallet like that, but it is possible. Perhaps consider tracking the whole portfolio of wallets as one to get a more complete picture…

Assets in a wallet

Now imagine you come across a wallet that minted 150 crypto punks and 25 Bored Apes and sold a dozen apes for over $200k at the previous top.

All of a sudden the same wallet starts buying some shitcoin or minting a NFT project with less than 500 followers on twitter….

As you can imagine this wallet could provide very valuable actionable trading information. (most likely the NFTs will be in a cold wallet so it may take some additional steps to trace a hot wallet back to the respective cold wallet)

I would caution that most of these whales know their wallets are being tracked and may use it against the overzealous sleuth.

Unusual Movement

Whale wallets can provide good context to price movement. Similar to the wallets that belong to collection founders, there could be some level of inference made that if someone is buying and selling a very large size or percent of volume of a coin, it's because they know something the market doesn't and they are acting on it.

I would caution that whales can often be wrong and don’t make the assumption that they can’t be hedging perps or other off chain derivatives. What you see could only be a small percent of what’s really going on in the overall portfolio of the whale.

Pre Sale/ ICO investors

Whenever pre sale or early investors sell a coin it could provide some information that’s usable in trading.

When an early investor sells out, they’re essentially stating to the market “I believe the present value of my coin/nft today is worth more than it will be in the future”

This could easily be the reason for the sale. However, the seller could of just wanted to buy a lambo or maybe they had to pay some tax attorneys.

I would caution against solely relying on any of this shit, as I’ve said multiple times, I like to develop a profile and use this information as a complement to everything else I’m looking at.

Dead (inactive) Wallets

this one is an obvious indicator but requires more effort than its worth for most traders.

For example, imagine if a wallet that is linked to Satoshi (or one of the wallets linked to the genesis block/first blocks on BTC), starts market selling - BTC would get chopped in half within the next few hours I bet.

However, this could potentially take hundreds of years if it even ever happens (low probability IMO), and you probably would miss the trade if you don’t have algos setup, or a 24/7 team with real time alerts dialed in.

Sloppy Whales

Another level to this is watching the type of orders whale wallets are using on DEXs or exchanges. Depending on the level of sophistication, you can potentially take advantage of “sloppy” whales.

What I mean by that is sometimes a huge market order can come in from a large player on chain that starts moving the price on a specific exchange or protocol - creating arbitrage opportunities.

However, this is much more advanced and I would caution against doing this unless you really understand orderbooks and have some type of automated trading bot or algo as that’s what your up against.

Order Books

Similar to the sloppy whales commentary, this is a much more sophisticated type of on-chain information and the quality of info varies greatly depending on what chain you’re trading on.

I’m not going to focus much on this as an automated element to your trading is probably needed to be successful here.

Here’s a link to what I consider one of the most important academic papers ever published on crypto

that paper should open your eyes up to more advanced types of crypto trading and some weaknesses ETH has/had as a chain that’s ignored by most traders.

Alt Coins

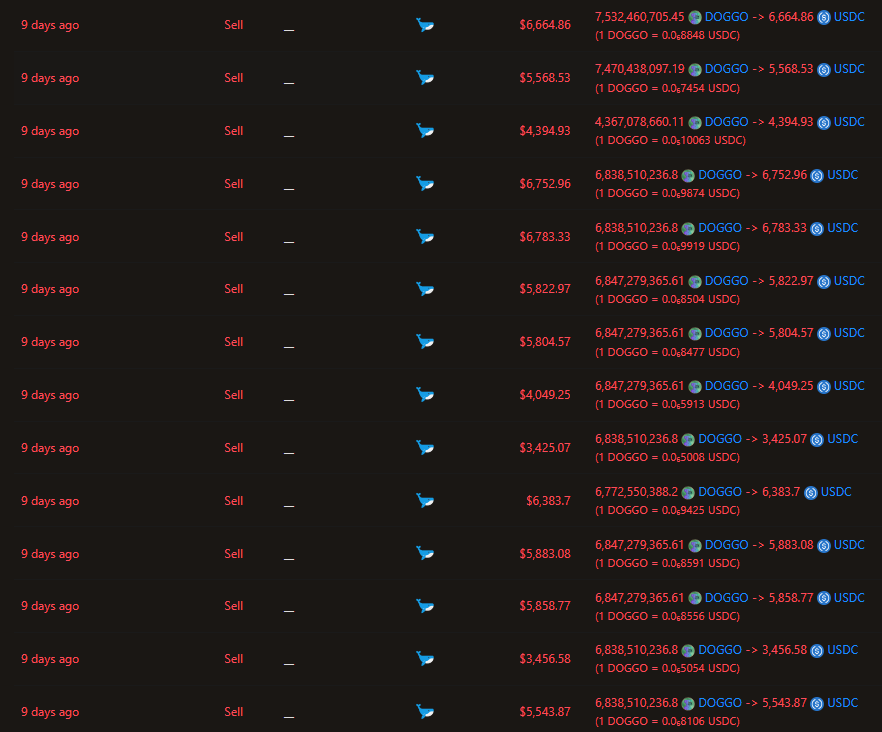

The below screen shot is a screen capture of some on-chain activity of a newly launched alt coin, all of that activity is from the same wallet.

That screen shot was taken within the first 48 hours of the token being created.

Since those sales the token is down ~70%, did that trader get lucky or did they know something the general market didn’t know? At the time, that selling represented the only transactions worth more than $3k USD EVER traded in that coin. A lot more on that wallet but I’ll leave it your imagination where the funds got sent after that….

Unusual volume is another very useful on chain metric to watch. If someone is 20%+ of the ADTV it’s worth watching that wallet, the less liquidity a coin has, the more important it becomes.

NFTs

Trading around lockups, seeing if early investors are selling

NFTs leaving the staking contract

Unique owner distribution

Whales moving NFTs to other wallets and then selling

Whale loan activity against NFTs

Notable Art collector wallet activity

I’m going to have a future newsletter solely focused on the above points so I’ll tease the above and link a thread below to a very simple on-chain peak at some unusual activity I looked into.

Please understand that the thread linked below is just documenting observations I saw on-chain and in no way accusing anyone of illicit activity or anything like that…..

Macro

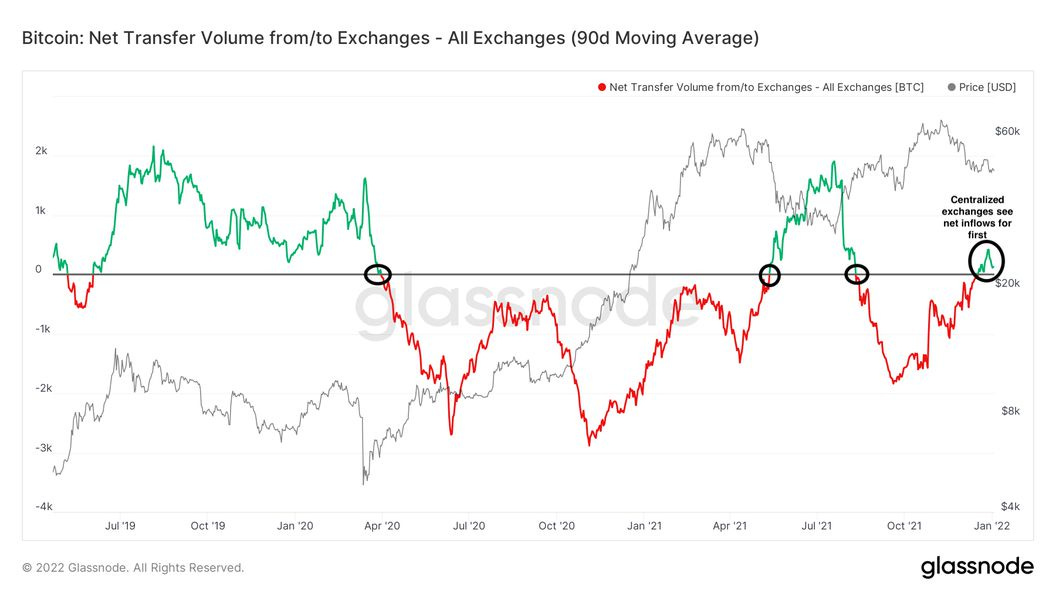

This is a tad out of my everyday focus of on-chain activity that I look at as I mostly care about short term trades using on chain data, however you would be foolish to ignore the causal relationship between the price of large cap crypto coins and the total amount of crypto on exchanges vs cold wallets + stable coin ratios.

The basic principle is that BTC (or any other crypto) in a cold wallet can't be sold (easily) without first moving the coin to a hot wallet or exchange wallet. So the more crypto off the exchanges and in cold wallets, the more bullish it is for the underlying crypto (less crypto on exchanges, more buying pressure on exchanges).

More on this in future letters but check out the chart below to get a general sense of what I’m talking about

Draw backs / How you will get tricked

I know people look at my wallets and try to copy trade. However, as with most of the wallets worth watching, I’m very aware of this…. The wallets linked to any NFTs I’ve tweeted about owning, I assume are “public” and I don’t really do any serious trading in those wallets because I’m somewhat of a privacy maximalist. I’m also quite familiar with protocols that obfuscate on chain connections - the point I’m getting at is NEVER ASSUME one wallet tells the whole story.

For example, you may see me buy 25 BTC and think that’s very bullish, however, little did you know that I’m buying back BTC to cover a short or hedge a short perp position that’s off chain….

Never forget that just because you think you may have the best information out there, whales are wrong every day and some also manipulate price action intentionally. On-chain information is best used as a complement to your entire due diligence process as with any other type of “indicator”

Tools

Knowing and playing around with all of the on-chain surveillance tools is a critical element for success

I’m not going to name any specific protocols or platforms here but I’ll drop some alpha on the types of tools that are necessary

Real time on chain activity tracker w/ charts

block explorers / platforms that allow you to label wallets

something that can push mobile notifications/telegram messages related to labeled wallets + speakers that will wake you up

platform that allows for on-chain visualization of on-chain activity between multiple wallets

Have a nice week,

zk SHARK

CONSIDER THIS AN INTRO LEVEL PRIMER ON ON-CHAIN ACTIVITY. The above text barely scrapes the surface of the information out there. If you want a better idea of what I mean by that, check out the middle part of my previous newsletter here, which goes into detail about all the information that can be gathered and used against you on the blockchain (more 1984-focused vs trading).

I’m considering turning on monetization for this substack for $8 a month - Let me know if you think that’s a good idea or not? ( you can pledge a sub with the button above <3) I would love to focus more on writing and publish letters more frequently, but time is money, especially knowing the type of alpha mentioned above. Additionally, the more I go into detail on specific trading strategies the more crowded the trade becomes (less return)…

I would also appreciate it if you shared the tweet below in your favorite alpha group.

Happy Shit Coin Season

NO INVESTMENT ADVICE

The Content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice. Nothing contained on this letter constitutes a solicitation, recommendation, endorsement, or offer to buy or sell any securities or other financial instruments.

All Content on this site is information of a general nature and does not address the circumstances of any particular individual or entity. Nothing in the Site constitutes professional and/or financial advice, nor does any information on the Site constitute a comprehensive or complete statement of the matters discussed or the law relating thereto. You alone assume the sole responsibility of evaluating the merits and risks associated with the use of any information or other Content on the Site before making any decisions based on such information or other Content.